Navigating the volatile world of forex trading demands a combination of robust strategies, disciplined execution, and continuous learning. Successful traders don't simply depend on luck; they develop well-defined plans that reduce risk while maximizing potential profits. Whether you're a novice aiming to enter the market or a seasoned trader wanting to refine your approach, mastering forex trading strategies is vital for long-term success.

- Utilize technical and fundamental analysis tools to spot profitable positions

- Create a personalized risk management plan that aligns with your level for risk

- Continue informed about market trends through constant analysis

- Practice your trading skills through demo accounts before venturing into live markets

- Modify your strategies based on market conditions and outcomes

Unlocking Profit Potential in the Foreign Exchange Market

The foreign exchange market, commonly forex, offers a dynamic and potentially lucrative platform for investors seeking to maximize on currency fluctuations. With its 24/7 nature and high liquidity, forex presents unique avenues to generate returns. Successful traders leverage a combination of technical and fundamental analysis to identify profitable trading patterns. It is essential to hone a sound trading strategy, control risk effectively, and stay abreast of market dynamics. By grasping the complexities of forex and employing disciplined trading practices, investors can tap into its profit potential.

Exploring Currency Fluctuations: A Forex Beginner's Guide

Diving into the world of forex can feel like venturing on an exciting but daunting journey. One of the most fundamental concepts you'll encounter is currency fluctuation. These constant changes in exchange rates can significantly impact your click here deals. As a beginner, familiarizing yourself with the factors that drive these fluctuations is vital for making informed decisions and mitigating risk.

Start by educating yourself on the various forces at play, such as economic indicators, interest rates, political events, and market sentiment. Maintain a close eye on these factors to forecast potential shifts in currency values. Build a solid understanding of technical analysis tools and chart patterns to recognize trends and possible trading opportunities.

- Utilize risk management strategies, such as setting stop-loss orders, to control your potential losses.

- Allocate your portfolio across different currency pairs to mitigate the impact of any single currency's fluctuation.

- Test your strategies in a demo account before committing real capital. This allows you to sharpen your skills and acquire experience in a risk-free environment.

Analytical Techniques for Forex Success

Technical analysis serves as an essential tool for forex traders looking to navigate the market. By interpreting chart patterns, traders can identify potential buy and sell signals.

A selection of technical indicators, such as moving averages, RSI, and MACD, assist in identifying support and resistance levels. Understanding these indicators facilitates traders to anticipate potential price movements and develop effective trading strategies.

However, it's important to remember that technical analysis is only one part of a successful trading strategy. Market conditions are constantly evolving, and traders must be able to adjust their strategies accordingly.

Fundamental Analysis and Forex Trading Decisions

Executing effective forex trading decisions hinges upon a robust understanding of fundamental analysis. This involves meticulously scrutinizing macroeconomic indicators such as inflation levels, political climates, and economic growth. By analyzing these factors, traders can assess the potential of various currencies and make insightful decisions about their positions. A thorough understanding of economic cycles empowers traders to capitalize on opportunities within the forex market.

Trading Risk Mitigation for Forex Traders

Forex trading presents huge opportunities, but it also involves inherent dangers. Successful traders understand the importance of robust risk management techniques to control potential setbacks. A sound approach should encompass several key elements:

- Establishing clear investment goals and aspirations

- Applying stop-loss orders to control potential drawdowns

- Spreading your portfolio across different currency pairs

- Regulating your position size to prevent excessive volatility

- Continuously evaluating your performance and making adaptations as needed

By utilizing these risk management guidelines, forex traders can enhance their chances of profitability. Remember, consistent restraint and a structured risk management plan are essential for navigating the volatile world of forex trading.

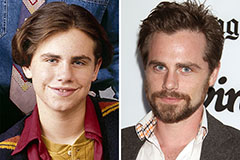

Rider Strong Then & Now!

Rider Strong Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now!